Interior Doors Market Trends

According to a new research report, the global interior doors market size was valued at $49,847 million in 2016, and is projected to reach at $74,967 million by 2023, growing at a CAGR of 6.1%. The swinging doors segment accounted for the largest share of global interior doors market revenue in 2016, and is expected to grow at a CAGR of 5.8% during the forecast period.

The demand for interior doors is driven by a surge in residential and non-residential construction, development of energy-efficient doors, and a surge in home improvement and remodelling.

Doors are manufactured using materials such as wood, metal, glass, fiberglass, fiberboard, vinyl, and others. The fiberboard segment is expected to see higher growth compared to glass, metal, and wood, due to its lower cost and beneficial properties. The residential segment is also expected to grow at a relatively higher rate during the forecast period. The developed regions, such as the U.S. and Western Europe, showed greater penetration of residential over non-residential construction due to a recovery in housing construction market. In addition, an increase in demand for non-residential construction, namely, lodging and commercial in the U.S. and office and retail in Western Europe is expected to boost growth. Furthermore, rapid industrialisation and urbanisation, a rise in population, and a surge in disposable income will propel growth.

The panel doors segment accounted for the highest market share in 2016, and is will maintain its dominance during the forecast period. The bypass doors segment is anticipated to grow at the highest growth rate, owing to the need for compact doors requiring less space to open. Moreover, a rise in consumer expenditure for renovation of homes and interiors and growth in new construction activities are expected to provide new opportunities for the market development.

The wood segment accounted for over 50% of the total interior doors market, owing to high dimensional stability and durability, resistance to chemicals, thermal insulation properties, high strength, strong aesthetics, and enhanced utility. Fiberboard and vinyl are expected to see increased usage and the highest growth rate in light commercial and institutional applications.

The swinging doors segment is anticipated to dominate the market throughout the forecast period, owing to increased adoption of hinged doors. The revolving and others doors segment is expected to grow at the highest CAGR of 7.8% in the interior doors market due to an increase in demand for space-efficient homes.

In 2016, the residential segment witnessed the highest growth rate in the market. The majority of the growth is expected in the emerging regions of Asia-Pacific and Africa. The residential segment is driven by the economic recovery in U.S. and Europe, a rise in living standards, an increase in disposable income, and growth in awareness related to the availability of energy-efficient and eco-friendly interior doors.

Asia-Pacific accounted for over 50% of the market share, and is anticipated to maintain its dominance during the forecast period.

Market players have focused on expanding their business operations in emerging countries by adopting various strategies such as, acquisitions and contracts/agreements. The major players profiled in the global interior doors market include Artisan Hardware, Bayer Built WoodWorks Inc., Chaparral Doors, Colonial Elegance Inc., Concept SGA., Contractors Wadrobe, Jeld-Wen Holding Inc., Masonite International Corporation, Rustica Hardware, and Simpson Door Company.

[edit] Find out more

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

Microcosm of biodiversity in balconies and containers

How minor design adaptations for considerable biodiversity benefit.

CIOB student competitive construction challenge Ireland

Inspiring a new wave of Irish construction professionals.

Challenges of the net zero transition in Scotland

Skills shortage and ageing workforce hampering Scottish transition to net zero.

Private rental sector, living standards and fuel poverty

Report from the NRH in partnership with Impact on Urban Health.

.Cold chain condensing units market update

Tracking the evolution of commercial refrigeration unit markets.

Attending a conservation training course, personal account

The benefits of further learning for professsionals.

Restoring Alexander Pope's grotto

The only surviving part of his villa in Twickenham.

International Women's Day 8 March, 2025

Accelerating Action for For ALL Women and Girls: Rights. Equality. Empowerment.

Lack of construction careers advice threatens housing targets

CIOB warning on Government plans to accelerate housebuilding and development.

Shelter from the storm in Ukraine

Ukraine’s architects paving the path to recovery.

BSRIA market intelligence division key appointment

Lisa Wiltshire to lead rapidly growing Market Intelligence division.

A blueprint for construction’s sustainability efforts

Practical steps to achieve the United Nations Sustainable Development Goals.

Timber in Construction Roadmap

Ambitious plans from the Government to increase the use of timber in construction.

ECA digital series unveils road to net-zero.

Retrofit and Decarbonisation framework N9 launched

Aligned with LHCPG social value strategy and the Gold Standard.

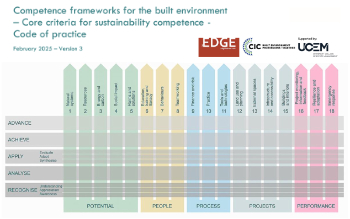

Competence framework for sustainability

In the built environment launched by CIC and the Edge.

Institute of Roofing members welcomed into CIOB

IoR members transition to CIOB membership based on individual expertise and qualifications.

Join the Building Safety Linkedin group to stay up-to-date and join the debate.

Government responds to the final Grenfell Inquiry report

A with a brief summary with reactions to their response.